Our Planning Process

Many of our clients come to us without a clear vision of their goals or how to achieve them. Before we begin developing your financial plan, we examine your goals, available resources, risk tolerance, and desired outcome. This process allows us to customize a comprehensive plan based on an understanding of your situation and realistic expectations.

Many of our clients come to us without a clear vision of their goals or how to achieve them. Before we begin developing your financial plan, we examine your goals, available resources, risk tolerance, and desired outcome. This process allows us to customize a comprehensive plan based on an understanding of your situation and realistic expectations.

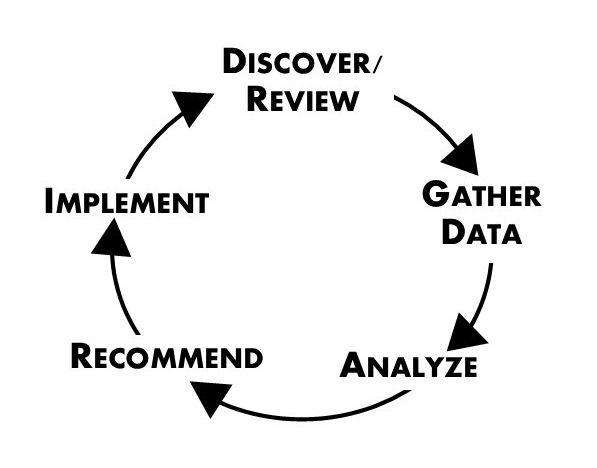

Steps in the Process:

- Discover: We discuss your goals & dreams, immediate & future needs, expectations, and financial worries

- Gather Data: You complete a fact-finder and risk tolerance questionnaire; You provide financial statements and any other pertinent documents (trust documents, etc.)

- Analyze: We review the information and data you provided and then conduct a detailed analysis based on your goals and priorities. We identify any obstacles or shortfalls and develop potential solutions.

- Recommend: Together, we review your completed financial plan and discuss proposed solutions to any issues or obstacles we identified during our analysis. We agree on a plan to move forward.

- Implement: You complete the necessary paperwork to open and fund investment accounts or to update/enhance existing insurance policies.

- Repeat/ Review/ Maintain: We schedule periodic reviews to ensure you remain on track to achieve your goals. Repeat data-gathering and analysis as your circumstances change.

We Keep Our Eyes on Your Goals

Our process helps you achieve ongoing success with:

- A written investment policy statement

- Periodic reviews

- Audits of products such as life insurance and annuities to ensure they are on track to meet your original objective